does wyoming charge sales tax

Many times an otherwise-taxable transaction will include bundled fees like excise taxes installation fees or finance charges or be modified with. The state sales tax rate in Wyoming is 4000.

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

However some areas can have a higher rate.

. In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Groceries and prescription drugs are exempt from the Wyoming sales tax. Sales Use Tax Rate Charts.

The state-wide sales tax in Wyoming is 4. Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area. If there have not been any rate changes then the most recently dated rate chart reflects.

We advise you to check out the Wyoming. There are additional levels of sales tax at local jurisdictions too. The state prides itself on.

Wyoming is known for its real estate tax benefits. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2. This page describes the taxability of.

So if you live in Wyoming collecting sales tax is not very easy. For example Juneau Borough charges a 5 sales tax on eligible purchases and it. Wyoming is a destination-based sales tax state.

In Wyoming there are currently no statutory provisions to impose sales or use taxes. If I buy cigars from a company in Colorado who is not a. Several other states such as Delaware South Dakota and Washington tax some services.

While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation. State wide sales tax is 4. Throughout Alaska many of their counties known as boroughs do charge sales tax.

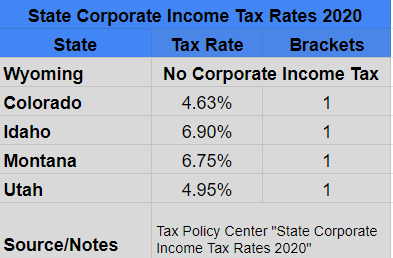

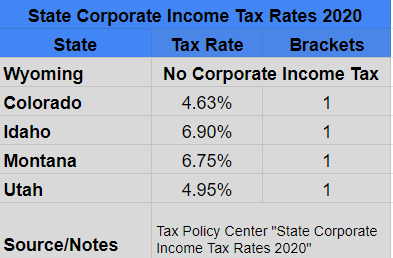

Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. It has low sales and property taxes and theres no estate tax capital gains tax or state income tax. And then theres California.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. Those were better times when the state was feeling flush. You can find more information above.

This means that a carpenter repairing a roof would be required to collect sales tax while an accountant would not. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. This page discusses various sales tax exemptions in Wyoming.

Wyoming does have a sales tax which may vary among cities and counties. Tax rate charts are only updated as changes in rates occur. With local taxes the total sales tax rate is between 4000 and 6000.

Wyoming has recent rate changes Thu Apr 01 2021. The wholesaler shall be entitled to retain four percent 4 of any tax collected under WS. View our complete guide to Wyoming sales tax with information about Wyoming sales tax rates registration filing and deadlines.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. You must collect sales tax at the tax rate where the item is being delivered. Does Wyoming charge sales tax on vehicles.

An example of taxed services would be one which sells repairs alters or improves tangible physical property. This state has a modified origin system in place in which state county and city taxes are origin-based but district transaction taxes are. In-state Sales The state of Wyoming follows what is known as a Destination.

There are currently five states that have no sales tax at all Alaska Delaware Montana New Hampshire and Oregon. Wyoming eliminated the sales tax on groceries in 2006 and made the exception permanent in 2007. Wyoming has a statewide sales tax rate of 4 which has been in place since 1935.

What is included in Wyomings sales tax basis. While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Currently combined sales tax rates in Wyoming range from 4 to 6 depending on the location of the sale.

Wyoming has a destination-based sales tax system so you have to pay. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from. In Wyoming when a tool is lost down a hole or damaged beyond repair during the pre-production casing phase of an oil or gas well the charge for the tool will not be subject to.

What States Have No Sales Tax on RVs. Are services subject to sales tax in Wyoming. See the publications section for more information.

This includes Wyomings sales tax rate of 400 and Laramie Countys sales tax rate of 200.

States With Highest And Lowest Sales Tax Rates

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Monday Map State And Local Sales Tax Collections Tax Foundation

How To File And Pay Sales Tax In Wyoming Taxvalet

How Do State And Local Sales Taxes Work Tax Policy Center

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

How To File And Pay Sales Tax In Wyoming Taxvalet

How Does Wyoming S Tax Structure Compare To Other States Wyofile

Wyoming Sales Tax Small Business Guide Truic

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Business State Tax Obligations 6 Types Of State Taxes

Wyoming Sales Tax Rates By City County 2022

Sales Tax For Online Or Remote Vendors A Study In Complexity Wyoming Small Business Development Center Network

Business Guide To Sales Tax In Wyoming

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation